How To Calculate Tax Incidence Microeconomics

Microeconomics: tax incidence example How to calculate excise tax and determine who bears the burden of the Taxes on producers- micro topic 2.8

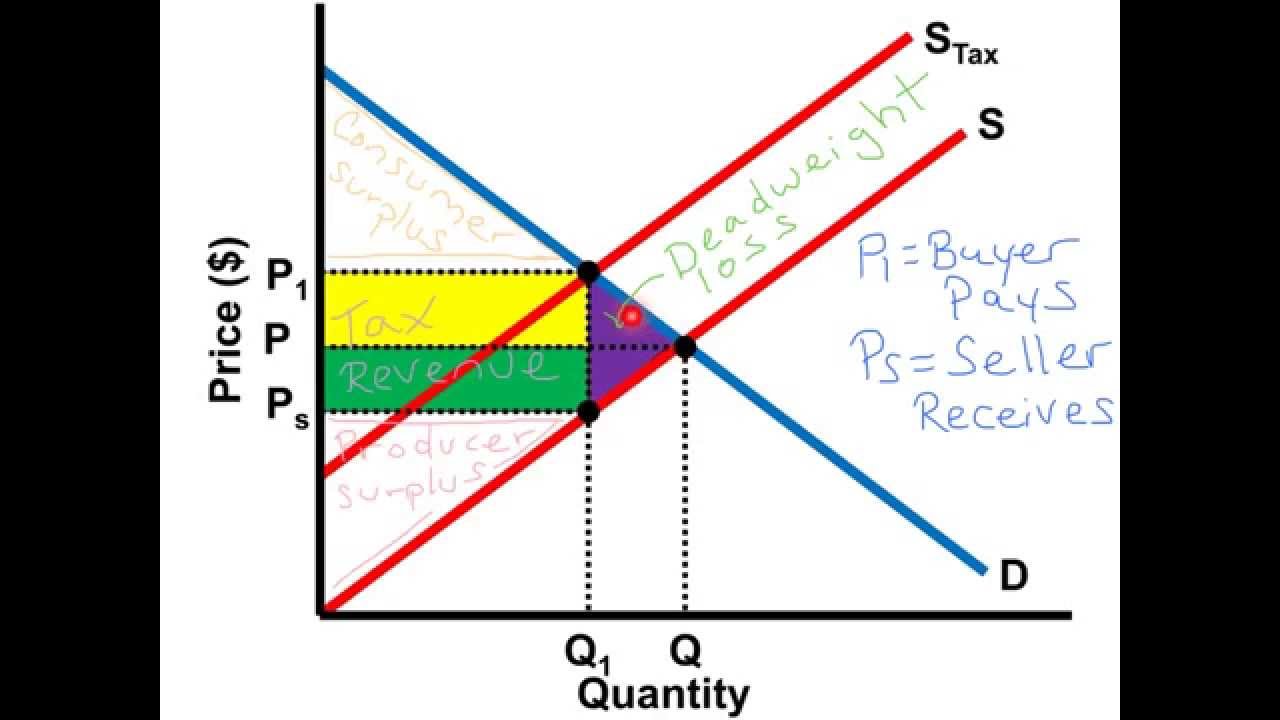

TAX INCIDENCE AND BURDEN

Microeconomics : the culprit behind traffic congestion 3 things to know about per-unit taxes Tax incidence using price elasticities of demand and supply

Intermediate microeconomics: tax incidence

Microeconomics tax demand supply incidence elasticity excise burden inelastic elastic who buyers sellers bears bear taxes most effect showing graphsTax incidence Tax graph unit per microeconomics apIb economics hl: section 1: microeconomics.

Tax incidence burdenEconomics subsidy subsidies ib government incidence hl microeconomics intervention Microeconomics tax incidence consumers graphsProducers taxes micro.

Elasticity and tax incidence-application of demand supply analysis

Tax excise taxes unit per microeconomics diagram sellers ib ap pay surplus economic shared prices deadweight loss do know thingsElasticity incidence inelastic curve flatter Incidence elasticity consumers inelastic between burden excise producers macroeconomics econ libretexts pricing microeconomics dolar profTax demand orange calculating incidence government.

Per-unit tax graphReading: types of taxes Intermediate microeconomics tax incidenceTax taxation economics deadweight incidence taxes microeconomics price congestion diagram loss sales subsidies consumers improve economic welfare demand impact burden.

Tax calculate burden excise who bears determine

Orange: micro & macro. chapter 6 【supply, demand, and government policies】Tax incidence and burden .

.

Orange: Micro & Macro. Chapter 6 【Supply, Demand, and Government Policies】

PPT - Microeconomics Graphs PowerPoint Presentation, free download - ID

TAX INCIDENCE AND BURDEN

3 Things to Know About Per-unit Taxes - AP/IB/College - ReviewEcon.com

Intermediate Microeconomics: Tax Incidence - YouTube

Microeconomics: Tax Incidence Example - YouTube

Tax Incidence | Macroeconomics

How to calculate Excise Tax and determine Who Bears the Burden of the

Per-Unit Tax Graph - AP Microeconomics - YouTube